Retail: Small and Midsize Retailers Can Drive Revenue, Efficiency and Loyalty with Smart Adoption of Advanced Technology

THE BRIEF

Small and midsize retailers around the world are seeing their businesses transform in a variety of ways. These firms, typically with fewer than 1,000 employees, have been transforming themselves as customers seek new types of engagement and as suppliers expect higher levels of efficiency and effectiveness. New business models and new competitors are changing the way retailers do business. Rather than simply reacting to new threats, successful retailers are leveraging technology in new ways to sharpen business practices, improve agility, and better serve customers while strengthening the role of retailers in the supply chain. Through digital transformation including the effective engagement of the Internet of Things (IoT) to track inventory and sell through — the opportunity to maintain and gain competitive advantage can be significant.

INDUSTRY DEFINITION AND CORE ATTRIBUTES

Small and midsize retailers, typically fewer than 1,000 employees, span product strategies, merchandise categories; channels to market — omnichannel, online, and store; value propositions on price, service, convenience; customer segments and behavioural profiles served, and sourcing, supply chain, and distribution models. In short, the small and midsize retail sector is as broad and diverse as retail as a whole. Older small and midsize retailers established business and technology models in profoundly different settings than they face today, posing a challenge to those who may underestimate the extent and nature of the change at hand. Most have been around for a long time and, because they are still small or medium-sized businesses, in the main they have grown slowly. In contrast, there are a few younger small and midsize retailers, some growing fast and shaking up their markets or creating new ones. However, for every innovator that breaks out to create a new market or product class, at least a hundred are stalled out or shrinking.

While many new small and midsize retailers are updating older business models with newer technologies, some are true innovators, shaking up retail with new products, categories, stores, and service concepts — some innovating in staid categories such as home furniture, others creating whole new categories such as athleisure wear, and still more carving out value in convenience such as ready-to-prepare meal subscriptions. As important as new, innovative merchandising can be, the greater challenge for many will be leveraging technology in ways that strengthen relations with supply chain partners as well as end customers.

The digital transformation of retail, from buying and sourcing to operations, merchandising, and sales, has changed the effect of economies of scale. Large retailers can definitely use them to reduce their “first costs” such as costs of goods sold, but small and midsize retailers can access source products just as easily as larger retailers — if not with greater ease.

INDUSTRY CONTEXT AND BUSINESS TECHNOLOGY DRIVERS

No matter their origin, value proposition, or merchandise sold, small and midsize retailers operate in markets undergoing profound changes in the customers they serve and competitors they face. Truth be told, as a group, the very largest U.S. retailers are losing market share, and those consumer expenditures are up for grabs. While that’s a positive trend for small and midsize retailers, other trends are not as favourable. Growth in real household incomes has been flat for years, and consumers are spending less of their disposable income on retail goods overall; in many categories, they spend significantly less as they spend more on experiences and services. Moreover, across many merchandise categories, market shares held by basics are declining — increasing variability in demand and accelerating cycle speeds. Omni-channel commerce gives more shoppers one-click access to many more retailers. Not surprisingly, agility is an imperative for success.

The consumer is changing too. Millions in the United States and billions worldwide are changing their shopping preferences and habits with greater speed and ease, putting retailers saddled with older enterprise, operational, and consumer-facing technologies at risk —

small and midsize retailers no less so than larger chains. Convenience, not consumption, is emerging as the new affordable luxury as the consumer adopts a new mantra — “My best experience anywhere is my minimum expectation everywhere.”

Small and midsize retailers tend to have a tough time of it as omnichannel commerce challenges one of their basic differentiators — being local. Being able to establish and reinforce a local market presence maintained by strong financials and customer engagement is the sweet spot for most successful small and midsize retailers, but building a local market presence is the aim of successful national chains too. For them, “thinking globally and acting locally” is a core strategy and operating principle, not an empty slogan. It plays out in just about every aspect of their business plans and practices. In merchandising, national retailers are focused on buying, assorting, allocating, replenishing, and pricing to local market conditions such as customer shopping patterns, competitors merchandising and marketing tactics, and attributes of large consumer segments.

Conventional retail is under siege, and the sting is felt most in the SMB tier. The rise of e-commerce sales, now a little more than 10% of total sales but vastly more and vastly less across merchandise classes depending on industry segments, has exacerbated a decades-old concern that the retail market is “over-stored.” Sales per square foot are declining. The industry has been hit by bankruptcies and store closures. National retailers are rethinking their store strategies, looking for new scale advantages in them such as fulfilment points and distribution centres in efforts to improve inventory productivity without cutting service levels.

Most want to reinvent their stores within their omni-channel strategies. Meanwhile, e-commerce and omnichannel commerce retailers are expanding into new digital sales, marketing, and customer service channels.

SMALL AND MIDSIZE RETAILERS’ BUSINESS PRIORITIES: STABILIZE, MOBILIZE, AND OPTIMIZE

Small and midsize retailers need to orient their business and technology priorities against the industry context previously described and take pragmatic account of their own particular circumstances with particular regard to the relative success of the key dimensions of their

business and their technology and business process maturity. They are an optimistic lot, with 80% seeing changes in their competitive environment positively as posing more opportunity than risk.

Depending on these factors, they should focus on stabilizing, mobilizing, or optimizing various parts of their business.

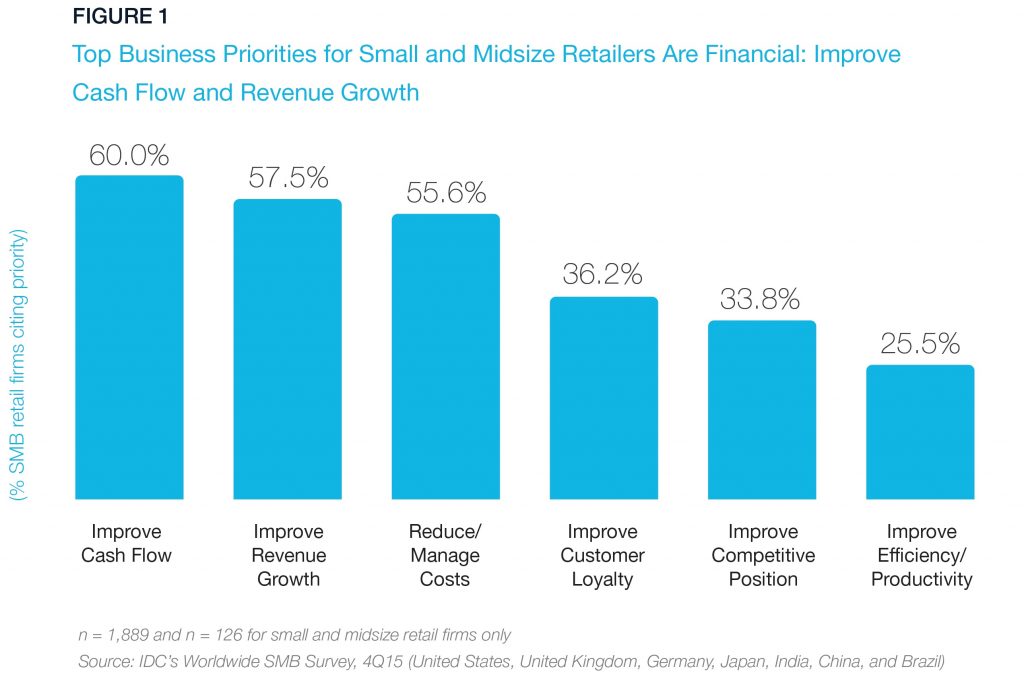

As Figure 1 shows, small and midsize retailers’ top 3 business priorities — improving cash flow, growing revenue, and managing costs — reflect these particular market conditions. Their fourth priority, improving customer loyalty, is tightly aligned with growing revenue. About one-third or more include improving customer loyalty and their competitive position at the top of their priorities, and a quarter includes improving efficiency and productivity.

BALANCE INNOVATION AND CAUTION

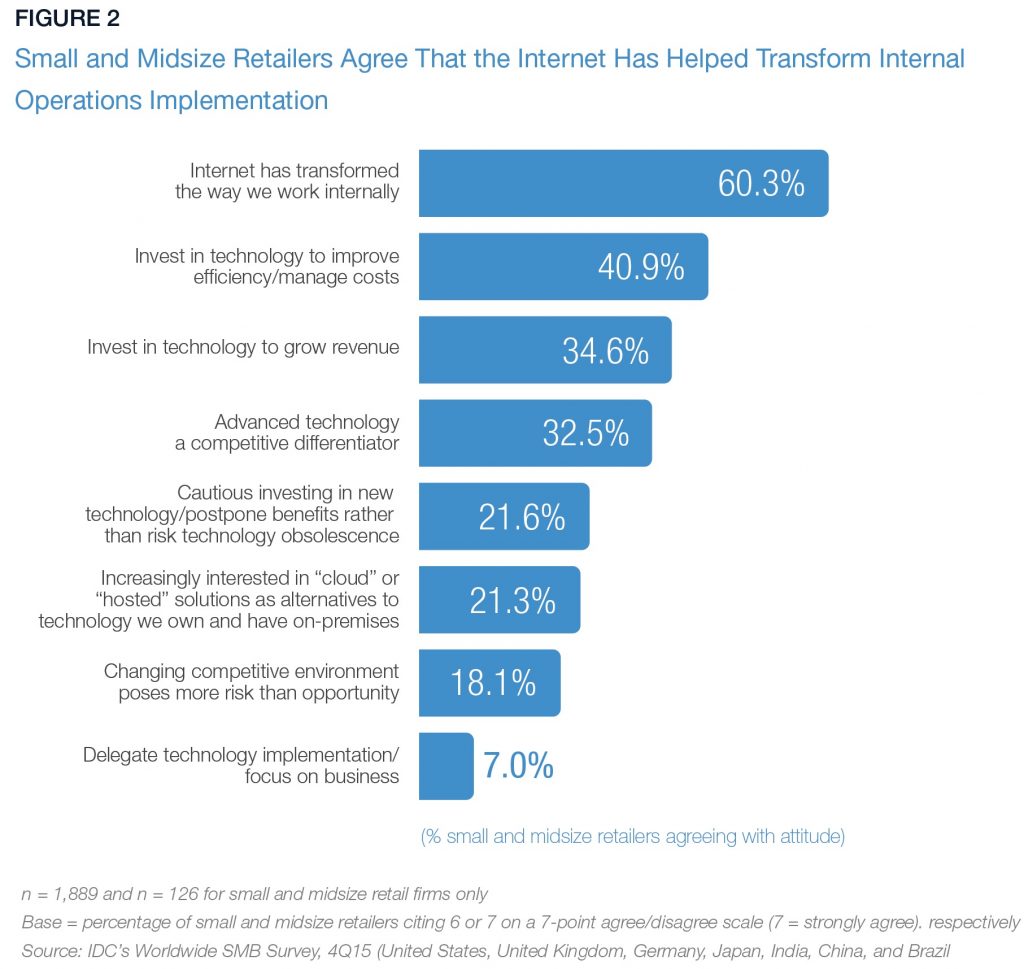

As Figure 2 shows, small and midsize retailers have the good sensibilities needed to achieve business objectives with advanced technologies. They understand the urgency of their situation. Retail is buffeted by store closures and bankruptcies. Leaders are shifting capital budgets from investments in traditional physical store assets to investments in a wide

range of digital, mobile, and analytics information technologies, including in-store wireless infrastructure, as stores become fulfilment points and centres of digital engagement.

In several respects, they are bullish on technology. In particular:

- One-third, 33%, of small and midsize retailers see advanced technology as an important competitive tool, a strategic resource. When asked a similar question, 38% of larger retailers plan to increase IT spending next year, with a majority citing growth as a key reason.

- More than three-quarters, 80%, don’t view themselves as cautiously investing in new technology. They’d rather take a technology risk than postpone the benefit their investment would yield. Of course, they want benefits most closely linked to their business goals to improve cash flow, accelerate revenue growth, and manage costs.

- They are true to form as retailers — optimistic. Four-fifths, 80%, see changes in their competitive environment positively as an opportunity, not a risk. They see successful innovation from start-ups and reinvention.

- They are rapidly gaining experience with and confidence in digital transformation — already 60% have transformed their internal operations with the internet. Success is not rooted in technology but in technology adoption. Half, 50%, invest in technologies to manage costs with efficiency/productivity.

- TCO and the commercial and support models for advanced technologies, especially cloud and managed service technologies, are tilting the playing field in favour of small and midsize retailers. However, only 21% say they are increasingly interested in cloud/ hosted solutions. We expect that many more small and midsize retailers will take to the cloud within the next two years. Most early-stage small and midsize retailers won’t even

consider applications that aren’t cloud-ready and mobile-enabled. Most more established small and midsize retailers will follow suit, and some will accelerate their refresh cycle to gain these advantages sooner. Their often limited/constrained financial position will be less of a barrier to taking advantage of superior technology.

On the other hand, continuing with Figure 2, we note that the SMB market remains cautious in some important regards:

- Less than one-tenth, 7%, delegate technology implementation to others, but the implementation models are changing. The game is adoption, not implementation, with SaaS, and to a lesser extent in the SMB market, IaaS and PaaS. Technology vendors themselves carry the implementation and cost of services. Proof point: Three times this number, 21%, are increasingly interested in cloud/hosted alternatives to what they now run on-premises. IDC believes that small and midsize retailers as a group are much more likely to adopt cloud/hosted solutions for what they do not now run on-premises. The path to cloud/hosted solutions is gathering momentum fastest in customer-facing systems of engagement. Proof points there will pave the way to wider adoption of cloud/ hosted systems of record.

- Already 35% of small and midsize retailers have invested in technology to grow revenue, compared with 57% that see revenue growth as a top priority. This gap will close. The classic barriers to technology investment — cost and risk — are falling. Simultaneously, there’s an ever-greater need to deploy technology smartly in key areas of the business.

KEY INITIATIVES

No matter how much their business changes over the next 5-10 years, small and midsize retailers need to stay focused on key processes, metrics, and outcomes reflected in their P&Ls, balance sheets, and customer engagement and satisfaction scorecards. Reaching for innovation shouldn’t unduly outstrip solidification and optimization of the fundamentals. Small and midsize retailers must strike the right balance and shift investment toward innovation as gains from investments in fundamentals taper off. In sum, they should adhere to the three directives discussed in the sections that follow.

Sharpen Inventory, Buying, and Pricing

- Improve inventory productivity: Reduce inventory balance, increase overall turns, focus buys on better sellers and higher-margin products, and rationalize assortments and space.

- Improve buying: Improve vendor and deal terms (discounts and price breaks).

- Enable capabilities: Focus on demand forecasting, replenishment, pricing, category resets/NPI, and space optimization.

Drive Revenue Growth Through Customer Engagement and Better Merchandising

- Increase same-store sales/space productivity: Rapid refresh of categories and on-trend products, assortment localization, and improved pricing.

- Improve customer sales: Average transaction value, increased wallet share in shopped categories, extended reach into under-indexed categories, and shopping frequency.

- Improve the shopping experience: Make shopping easier and more convenient with connected contextual omnichannel marketing and personalized promotions supported by digital channels.

Solve the “Reduce Cost/Improve Service for Success” Equation

Initiatives to improve cash will go a long way toward improving this trade-off. In addition, small and midsize retailers should invest to improve customer service in stores and increase store labor productivity. More generally, they should use technology to reduce process variability with better data and analytics.

Additional key points are as follows:

- Store labor is the number 1 expense after the cost of goods sold, but retailers are hard-pressed to continue in the mindset of accepting reductions in customer service and store operations in order to manage labor expenses. Smart, targeted investment in in-store technologies can improve this trade-off dilemma.

- Investing in technologies to reduce or slow the growth of costs is a good strategic guideline. Key cost drivers to address include process variability and non-conformance, slow decision-making, poor quality data for decision-making, and slow, partial dissemination of new practices and policies.

To Download the report Click here

Comments are closed